EBB Paper Market Review

August 2021

Demand for paper is reaching pre-COVID levels

Demand for paper is reaching pre-COVID levels

- As economies continue to return towards pre-pandemic levels of activity, demand for paper following a similar trajectory.

- This is placing demands on supply following the loss of paper making capacity in globally as mills shut or convert to packaging

- In Europe there has been a reduction in imports from the rest of the world as their home markets recover

- This is compounded by Logistics challenges to global shipping

- In addition to increased demand for traditional markets the move from plastics is placing increasing pressure on the demand for cellulose-based commodities

- Raw material shortages, for example recycled fibre, are hitting manufacturing capacity and putting pressure on virgin fibre resources

- The increased demand for raw materials and transport are driving up costs across manufacturing industries

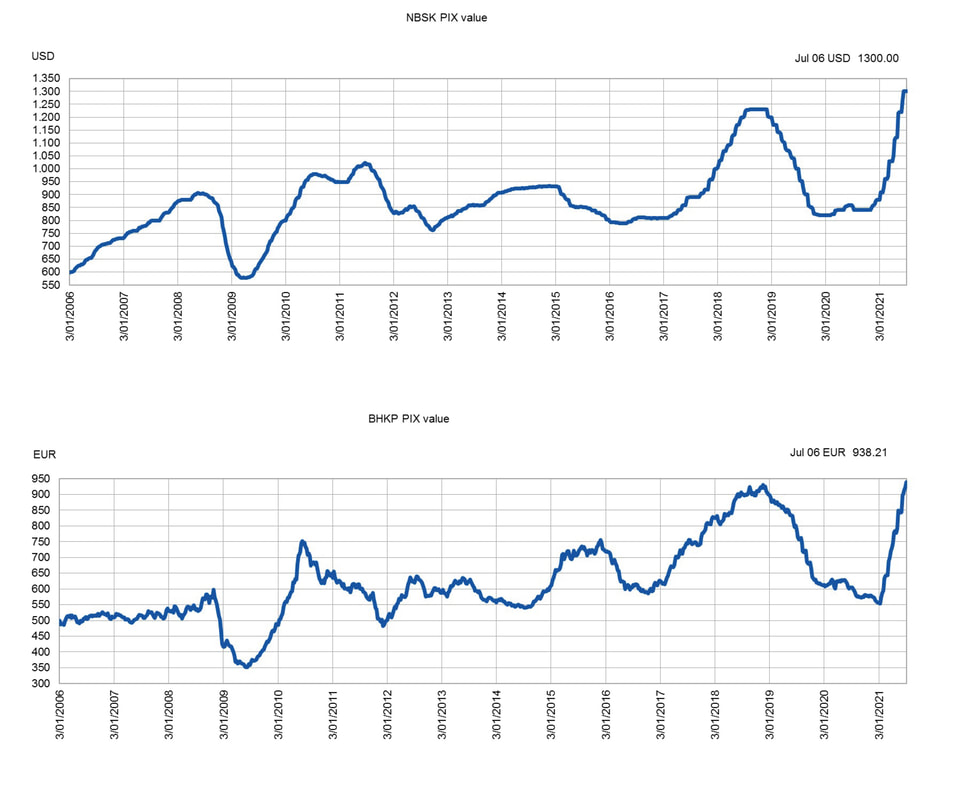

Pulp Price Development – an unprecedented level of pricing in 2021

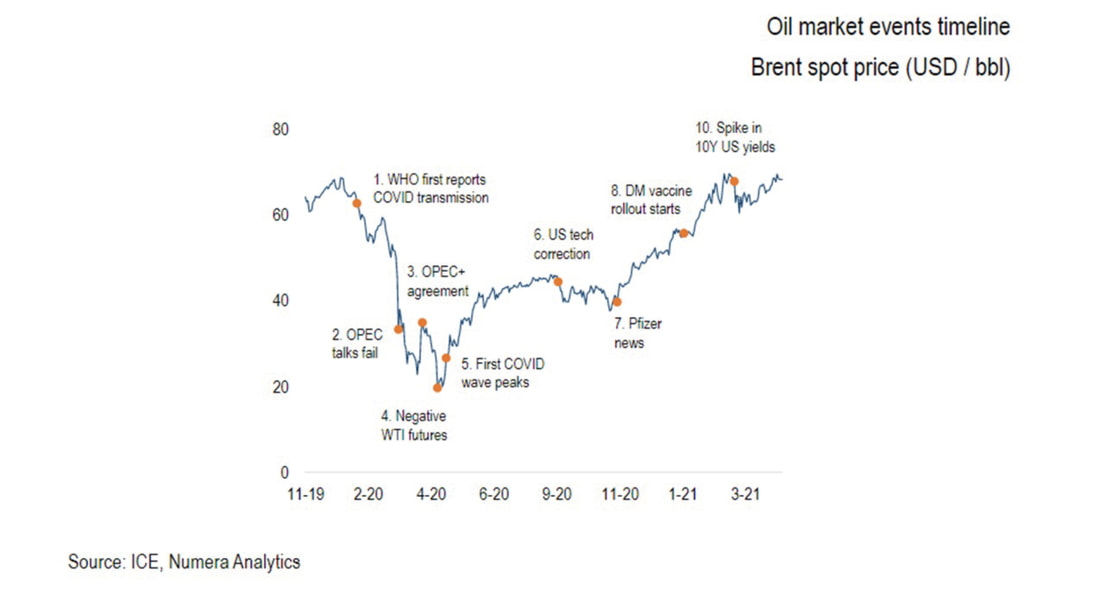

Costs – Oil continues to rise as a result of supply restrictions and rising demand

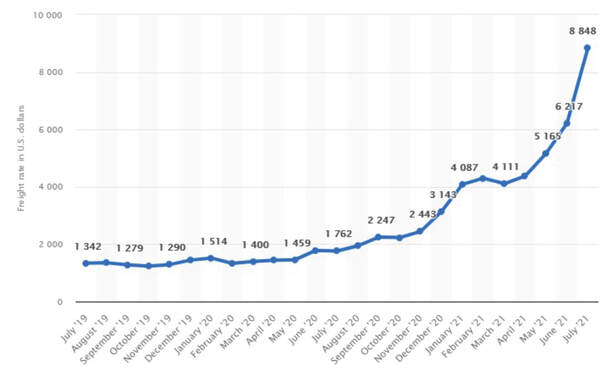

Freight

International container costs continue to rise as a result of disruption to the network caused by the pandemic. Well publicised factors are affecting haulage across Europe, leading to increased costs and lower availability. These represent a significant cost pressure on both raw materials and finished goods.

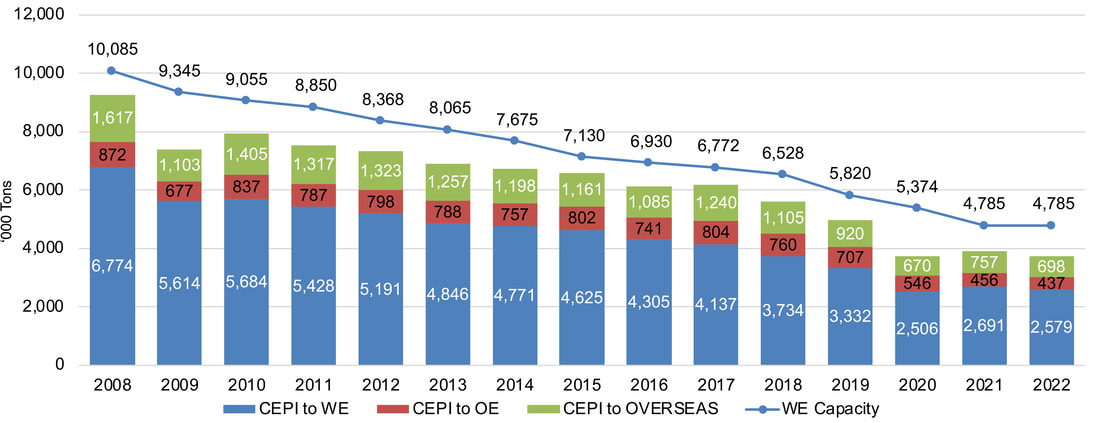

WE CWF capacity and demand

WE = Western Europe

OE = Other Europe

CWF = Coated Woodfree

Source: EURO-GRAPH/ PPPC/ SEU April 2021

OE = Other Europe

CWF = Coated Woodfree

Source: EURO-GRAPH/ PPPC/ SEU April 2021

Outcomes

As a result of closures and increased demand, order books for European manufacturers have significantly increased, this has increased lead times to levels not seen in the last decade.

As a consequence, pressure on stocks have reduced mill inventory levels considerably, which in turn will place more pressure on lead times.

Manufacturers of graphical papers and boards are continuing to implementing increases globally.

The sustained upward pressure on costs, combined with the alignment of supply and demand will continue to put upward pressure on prices into 2022.

As a result of closures and increased demand, order books for European manufacturers have significantly increased, this has increased lead times to levels not seen in the last decade.

As a consequence, pressure on stocks have reduced mill inventory levels considerably, which in turn will place more pressure on lead times.

Manufacturers of graphical papers and boards are continuing to implementing increases globally.

The sustained upward pressure on costs, combined with the alignment of supply and demand will continue to put upward pressure on prices into 2022.